I’ve Started Using the 50/30/20 Rule as My New Budget Strategy…and I Love It

If you’re new to my blog, welcome. For everyone else, welcome back! 🙂 I’ve written before about how I’ve adopted a new ‘no budget’ budget where I didn’t focus too much on allocating a set amount for every budget category such as rent, utilities, restaurants, etc. However, I’ve recently had a chance of heart and have started using the 50/30/20 budget strategy and it’s brought new freedom to my spending and investing.

What is the 50/30/20 budget strategy anyways?

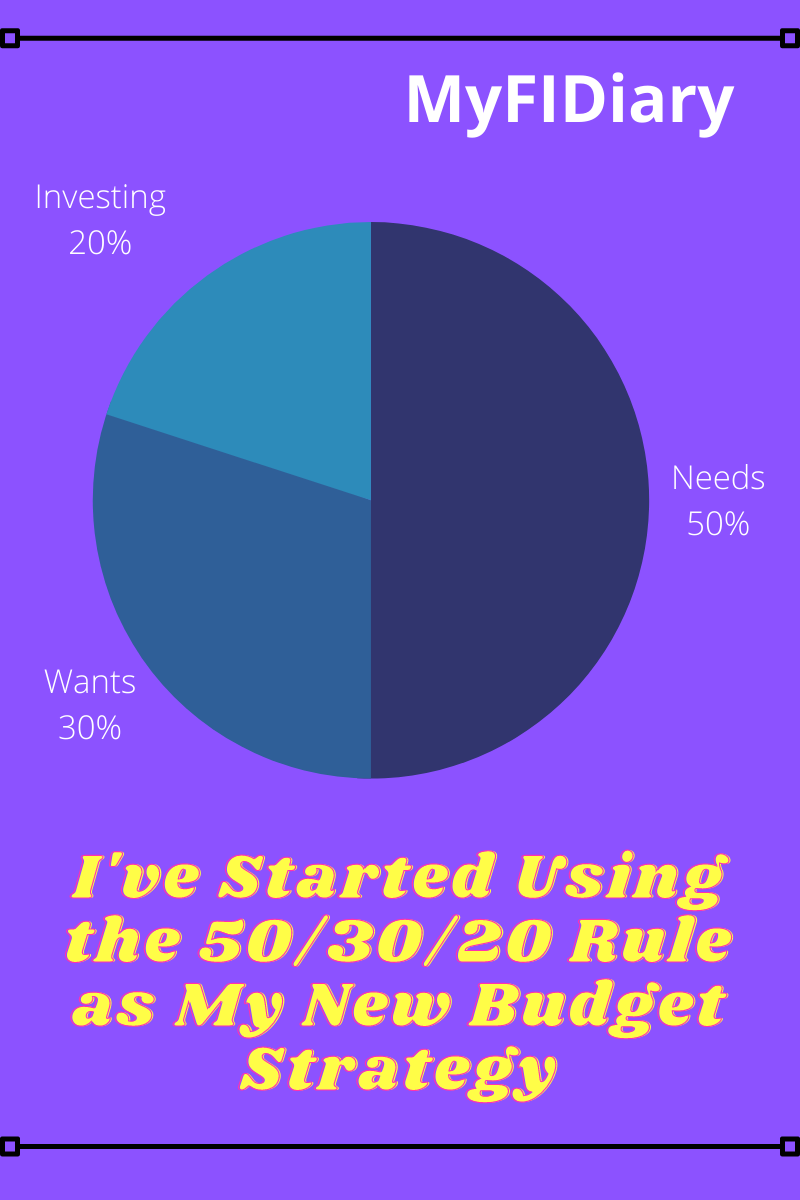

I learned about it after listening to a money management talk from a financial advisor at my new job. Although I had vaguely heard of it before, I’ve never started using it until about one month ago. Basically, the 50/30/20 budget strategy helps you divide up your monthly income into different percentages. Each percentage is going to be dedicated to a specific purpose. 50% of your monthly income goes to your necessities (food, rent/mortgage, utilities, insurance), 30% goes to your wants (shopping, eating out, vacations), and the other 20% goes towards saving, investing and debt pay down. It’s a way to neatly know exactly how much money should be going towards each category.

If you’re wondering how much should go to each category, find out what you make each month after taxes and use this handy 50/30/20 budget calculator from Nerd Wallet. They also do a great job of breaking down the concept further with a great visual.

How I Adjusted It To Fit My Needs

During that money management talk at my job, the financial advisor said something that caught my attention. I knew about most of what he was saying but when he came to the 50/30/20 rule he casually mentioned “…and for those of you who want to retire early, flip the 30 and 20 to have 30% going towards investments and 20% going towards wants…”.

I felt like he was speaking directly towards me! I normally only invest my commission money since I’m in a job with a salary and commission compensation structure. But now, since I make $20k extra in my new job, I thought I could challenge myself to invest from my monthly salary as well. I knew that I could do that AND invest my commission money. It would help me accelerate my timeline towards financial independence, or at least have a higher number that could support my desires to travel and be able to spend money on what I wanted to without feeling the pinch.

It’s Allowed Me to Enjoy Spending Money Again

It’s easy to think that being a part of the Financial Independence Retire Early (FIRE) movement is full of people who are frugal or who happen to be penny pinchers. They often get the most attention. A lot of people try to spend as little as possible in order to reach their FIRE number quicker and retire on a lower budget. That’s okay for some people, but for me, I want to have the same lifestyle after I no longer have to work full time. I used to limit myself to how much I could spend on my wants. But now, I’ve given myself permission to spend money any way that I want to. I have a set number of money set aside that doesn’t interrupt my investing. It’s been so freeing! I’m able to spend that set 20% guilt free knowing that my investments are still continuing to grow every month.

In conclusion…

I’m going to continue using the 50/30/20 rule as my new budget strategy. I’m curious to know if you’ve used it before and if so, what did you like or dislike about it? Feel free to comment below.