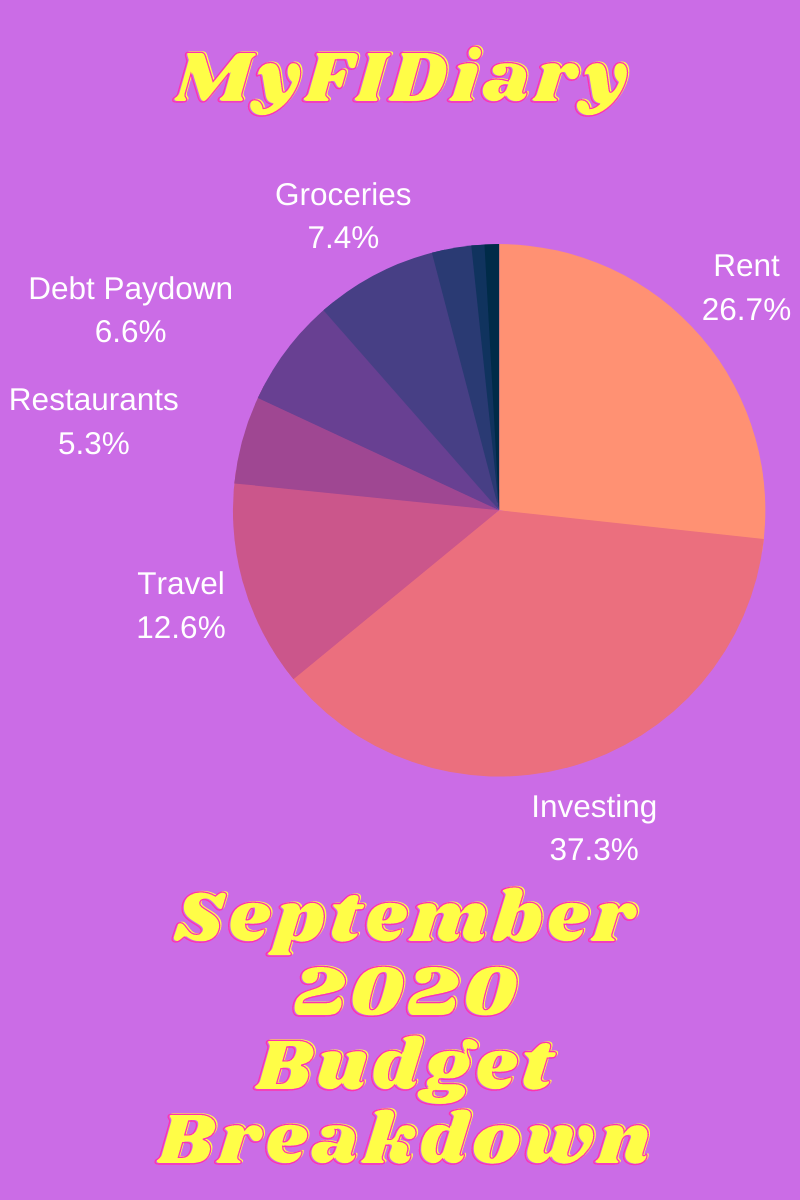

September 2020 Budget Breakdown

Hello everyone! If you’re new to my blog, at the beginning of each month I take a look at the previous month to see what I saved, invested, and spent. I’m in the beginning stages of my journey to reach early retirement and reach financial independence. A great way to do this is by tracking your expenses, which I do with a great platform called Personal Capital which is completely free to use. I have all of my checking accounts, credit cards, Roth IRA, and brokerage account linked to it which makes it easy to get a birds-eye view of my spending and saving habits.

If you missed my August 2020 budget breakdown you can read that by clicking here. This month I went to a friend’s wedding in Las Vegas, Nevada and celebrated an early 2-year wedding anniversary so there will be some items in here that aren’t a part of my day to day life. So, here we go!

Savings & Investing $1,700

This month is the second month of investing $1,000 per month into my Vanguard brokerage account. This is the account that will provide me with income for early retirement because I don’t have to wait until I am 59.5 years old to draw money from it. About 90% of it goes towards the Vanguard Total Stock Market ETF (VTI) and about 10% goes into the Vanguard Total Bond Market ETF (BND). I just buy shares based on the dollar amount after the amount has been automatically transferred from my savings account. I also invest $500 per month into my Vanguard Roth IRA to meet the $6,000 yearly limit which also goes into VTI & BND. The other $200 per month goes into my company’s 401k. My company unfortunately doesn’t have a 401k match, so I just started contributing to taking advantage of pre-tax savings. I might reconsider this for next month and put more money towards my brokerage account and max out my Roth IRA early by the end of the year.

Travel $571.91

This month we were invited to our friend’s wedding in Las Vegas, Nevada. We originally planned on flying but flights from San Jose, CA and SFO were over $300 per person round trip. To my husband and I this seemed ridiculous for a 1.5 hour flight. We knew that we wanted to have a car while in Las Vegas so that we could eat off of the strip and be able to get to the wedding easily without having to rely on Lyft/Uber or rent a car.

We decided to drive to Las Vegas and use the money that would have been used on a flight and rental car to go towards a 5-star hotel and delicious meals away from the strip. Since our 2-year wedding anniversary was less than a month away it was also a way to do two things at once, enjoy our friend’s wedding and celebrate our anniversary. We ended up staying in the Delano which is the sister property next door to Mandalay Bay. We chose the Delano because it was an all-suite hotel, had no casino, and allowed us to take advantage of the pool at Mandalay Bay (which we happily did). The experience was well worth the cost and we enjoyed restaurants that were owned locally and gave back to the Las Vegas community that were away from the strip.

Rent & Utilities $1216.39

I live with my husband in the East Bay area of the San Francisco Bay Area. We split the cost of rent and utilities that include our apartment insurance, our gas bill, the electric bill, water bill, and sewage. I think the price is quite fair considering how expensive the San Francisco Bay Area is.

This month’s bill was a bit lower than the past month’s bill. I’m pretty sure that it’s due to me being hyper vigilant about turning off all lights when I’m not in the room and opening up windows to get airflow instead of using an electric fan. We currently don’t have an air conditioner in our apartment which is quite common in the Bay Area. We do plan on moving this December and will make having a/c a priority so I expect our electric bill go up after we move.

Groceries $337.32

I came slightly above my monthly goal of only spending $300 per month on groceries. I only spent about $230 last month so I’m not too worried about this. I can be more aware of shopping sales, meal planning, and making sure that I eat everything in my refrigerator and pantry. I plan on getting back to my monthly bill in October.

Charitable Giving $36

This item stays exactly the same month to month. I always give $36 per month to the Save the Children which helps sponsor a smart, adorable girl in Kenya. This money goes towards providing her and her family with clean water, school fees, and school supplies. I plan to write to her and her family again soon to make sure they are staying safe during these tough times.

Subscriptions $39.97

This category includes my Netflix subscription, Amazon prime membership and a monthly payment to support two YouTubers that I enjoy watching, and a one-time payment during a super chat live video session. Considering how my husband and I utilize Amazon prime movies and Netflix as a good way to unwind and have a ‘date night’ from home, it’s worth the money.

General Merchandise $109.11

This category includes general spending as well as personal shopping. I bought some medicine at CVS pharmacy, buying a blood pressure machine and a portable bidet for our trip to Las Vegas. I am so used to my Tushy bidet at home and needed a good alternative for travel.

Restaurants $242.49

The majority of this was spent on meals, snacks, and drinks for our trip to Las Vegas, our time in Vegas over a weekend, and our trip back home. We didn’t pay too much attention to the prices of the restaurants that we went to but made sure they were good quality and had decent reviews on Google. We also have an order of Mountain Mike’s Pizza and Chili’s that we sometimes treat ourselves to on the weekends.

Debt Paydown $300

This $300 goes towards my Upstart Personal loan. I paid off my credit card debt with a low-interest personal loan. I’m paying $100 more than the minimum payment and am on track to paying off the loan in 2.5 years. I may pay it off early depending on my commission money from work and what next year looks like.

In conclusion…

September was a great month for me. I took on a side hustle with an organization that I care about, how a personal life change, and attended a lovely wedding. I made a lot of great memories by having great experiences that I will never forget. My total spending, savings, and investing this month came to a total of $4553.19. I had higher than normal expenses in travel this month, spent a bit more on groceries, but managed to keep my savings steady due to automatic investing from my checking account.

Do you track your spending? If so, tell me how you do so and I’d be happy to hear from you!