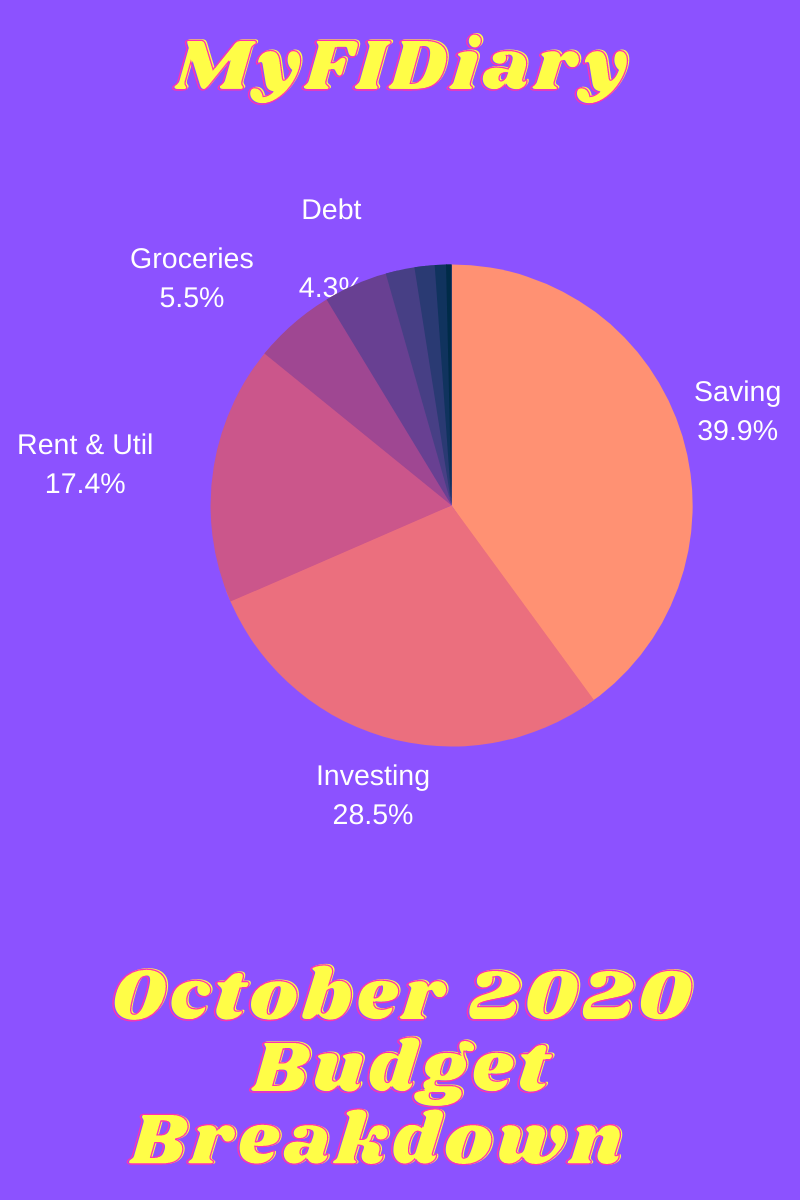

October 2020 Budget Breakdown

Hello everyone! If you’re new to my blog, at the beginning of each month I take a look at the previous month to see what I saved, invested, and spent. I’m in the beginning stages of my journey to reach early retirement and reach financial independence. A great way to do this is by tracking your expenses, which I do with a great platform called Personal Capital which is completely free to use. I have all of my checking accounts, credit cards, Roth IRA, and brokerage account linked to it which makes it easy to get a birds-eye view of my spending and saving habits.

If you missed my September 2020 budget breakdown you can read that by clicking here. This month I didn’t go any road trips and stayed local to my town. I received a commission check from my sales job which doesn’t happen every month but happens quarterly. Let’s dig in!

Investing $2,000 USD

This month I invested $1,500 into my Vanguard brokerage account. This is the account that will provide me with income for early retirement because I don’t have to wait until I am 59.5 years old to draw money from it. About 90% of it goes towards the Vanguard Total Stock Market ETF (VTI) and about 10% goes into the Vanguard Total Bond Market ETF (BND). I just buy shares based on the dollar amount after the amount has been automatically transferred from my savings account. I also invest $500 per month into my Vanguard Roth IRA to meet the $6,000 yearly limit which also goes into VTI & BND. My company’s 401k doesn’t have a match so I decided to stop contributing to that and roll it over into Vanguard by the end of the year.

Saving $2,800

This month I decided to add to my emergency fund to account for some extra costs next year and help provide a buffer for a move next month. My partner and I have decided to stay in the East Bay Area in Northern California. He got a new job and I picked up a side hustle. We will be needing a 2-bedroom for the extra space so that we can accommodate us both being able to work from home when needed and be able to host family in the near future.

My emergency fund was $15,000 which would be roughly 7 months of monthly expenses for me. I decided to add to it to get it closer to 9 months of monthly expenses by December to accommodate for higher costs in rent and some potential unexpected costs.

Travel $9.95

This cost is for local travel within my city to pay for an Uber. I had a Doctor’s appointment to attend and my husband could only drop me off so I took an Uber on the way back home. I made sure to ride in the back seat with the window down while wearing a mask. The ride was only for about 10 minutes and includes a $3 tip as well.

Rent & Utilities $1218.07

I live with my husband in the East Bay area of the San Francisco Bay Area. We split the cost of rent and utilities that include our apartment insurance, our gas bill, the electric bill, water bill, and sewage. I think the price is quite fair considering how expensive the San Francisco Bay Area is.

This month’s bill was about $2 more than the past month’s bill. Somehow our gas and electric bill is always lower than our water and sewage bill. I think that’s because our water and sewage is split evenly between all the tenants in my apartment complex so I don’t have much control over this expense.

Groceries $383.48

After paying attention to my grocery spending I’ve decided to adjust my budget to $400 for groceries each month. This is the cost of groceries for my partner and I. I’ve incorporated more fresh fruits and vegetables into our diet and we try to cook more batch meals to last multiple days when we can. I’ve discovered a new love for Ben & Jerry’s ice cream which has contributed to this increase as well.

Charitable Giving $135

I always give $36 per month to the Save the Children which helps sponsor a smart, adorable girl in Kenya. This money goes towards providing her and her family with clean water, school fees, and school supplies. I plan to write to her and her family again soon to make sure they are staying safe during these tough times. This month included a $99 quarterly donation to Child Fund International which helps sponsor another young girl in Kenya to help pay for school fees, food, and clean water.

Subscriptions $25.85

This category includes my Netflix subscription, Amazon prime membership and a monthly payment to support two YouTubers that I enjoy watching. I’ve recently started binge watching Girlfriends on Netflix and enjoy finding movies to watch with my partner on Amazon Prime so we get our money’s worth out of this category!

General Merchandise $94.37

This included buying items on Amazon to help make my work from home space more comfortable. I purchased a new laptop stand, a seat cushion, a wireless keyboard and mouse set, and a mouse pad. It’s made my posture much better and I’m very happy with my purchases.

Restaurants $52.46

This month I brought my restaurant spending down significantly. My husband and I have been cooking more from home and only ordered chicken wings once and Dominos pizza on another occasion. We treat ourselves occasionally to some takeout but if we needed to eliminate this expense entirely, we could.

Debt Paydown $300

$300 goes towards my Upstart Personal loan that I took out to pay off my high interest credit card debt. I still use my Chase Sapphire Preferred card to put most of my expenses on but I pay the statement balance off in full every month to not accrue anymore debt.

In conclusion…

October was a pretty good month. I got a commission check that I used to add extra money to my emergency savings fund and add a buffer to my checking and main savings account.

In total, my investing, saving, and spending this month came to a grand total of….$7019.18 USD. Out of this amount, almost 70% went towards investing and saving which I am particularly happy about.

Do you track your spending? If so, tell me how you do so and I’d be happy to hear from you!

Great post! We are linking to this particularly great post on our site. Keep up the good writing. Chery Germayne MacDougall

Thanks to my father who informed me about this webpage, this weblog is genuinely remarkable. Tedi Herbert Alyce

Awesome! Its truly amazing post, I have got much clear idea about from this post. Milka Geordie Thorpe

Very good article! We are linking to this great content on our website. Keep up the good writing. Pauletta Judd Clarita

Thank you very much, Pauletta. I would love to learn more about your site.