My May 2020 Budget Breakdown- Second Full Month in Quarantine 🏠

I’m going to be honest with you all. I didn’t feel like writing this post. I’m exhausted, angry, and emotionally tapped out. The recent unjust killings, protests, and the “aha” moment that many Americans are just not having has been a lot for me to go through. As a black woman in the personal finance and financial independence space, I thought that it was imperative that I acknowledge that. But, this is just business as usual. There is and always has been systemic inequities in the US (and around the world) that I’ve had to navigate through. It’s one of the reasons why I felt compelled to start my own blog to document my journey and motivate others.

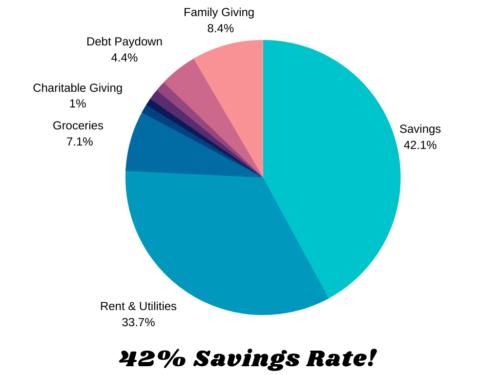

Here I am! This is month two of my budget breakdown. I write these to help keep myself accountable, go through my prior months purchases (and savings) and help provide transparency into the spendings of someone who is in the beginning of their journey of debt paydown, savings, and investing to lead to financial independence.

So here we go!

Savings $1500

I fell a little bit below my 50% savings goal for this month. I surprisingly am not upset at this. Every dollar counts and as 42% savings is much higher than what I was able to do in the past. I have completed a 4 months savings emergency fund and opened another long term savings account ‘sinking fund’ for my future goals. I’m not exactly sure what this will be for but wanted to have it separate from my emergency savings fund.

It will most likely go to being a down payment for a multi-family home, savings to help me take a sabbatical for over 4-months if I ever choose to take a break from working in the future (and still be able to help pay my bills). Having money beyond a normal 3-6 months emergency fund buys you a little bit of freedom. Freedom to take a risk in moving, becoming a digital nomad (again), or just being prepared for an unplanned expense.

Rent & Utilities $1200.80

I live with my husband in the East San Francisco Bay Area, aka ‘East Bay’. Our prices aren’t quite as drastic as San Francisco, but is still quite a bit more expensive than our former apartment in South Texas.

This cost went up a bit this month. At my apartment complex, our water and trash bill is split evenly between all residents. I usually keep my Pacific Gas & Electric (PGE) bill quite low by only using a fan when I get hot, working outside when I want a breeze, and batch cooking to save on energy from cooking. Since more people are working from home longer term due to a lot of large employers in the Bay Area allowing employees to work from home until the end of the year (or forever) the water usage has gone up a bit.

Groceries $252.15

I somehow spent about $100 more on groceries this month compared to last month. A lot of our frozen meat, pastas, and other staple pantry foods that we had been using ran out and we needed to restock. Although this is still below my personal grocery budget of $300, I can still be more frugal and plan my meals more efficiently to drastically bring this cost down in the month of June.

Charitable Giving $35

I always give $35 per month to the Save the Children which helps sponsor a smart, adorable girl in Kenya. This money helps to pay her school fees, provide any needed school supplies, and provide clean water for her family in her village.

This is the only charitable giving I gave this month but I plan to give more in June to help battle voter suppression, bailing out protesters, and other organizations that do anti-racism and equal rights work for Black people and other people of color.

Entertainment $29.63

This includes Netflix and YouTube creator support to two Vloggers that I decided to support with a $5 per month payment. I watch and enjoy their content and felt that this small payment is a token of my appreciation that I could afford to give.

Household Shopping $44.33

These purchases are for household items such as toilet tissue and a digital scale. I have been intermittent fasting for the past two weeks and wanted to be able to track my weight.

Restaurants (Takeaway Food) $43.75

Restaurants in my county of Northern California are still not open for dine-in “dining”. To be honest, even if they were, I still don’t feel safe enough to do it. These are for two takeaway meals to support local restaurants and was shared between my husband and I. We usually get one takeout meal every other weekend as a small treat and break from home cooking.

Debt Paydown $158.17

These are the minimum credit card payments that I made for the month of May. I was using the snowball method for paying down debt before mid-March this year but quickly paused that when the coronavirus epidemic started. I felt that it was smarter to take that money to build a larger emergency savings fund just in case my job security was threatened.

I’m lucky enough to still be working from home in my current role. I also plan to use part of my commissions check in the end of July to pay off my remaining credit card debt. Then it will be wiped clean and I can focus on investing!

Family Giving $300

I am in a more financially secure position that a close family member. I am choosing to help her pay down her credit card debt and assist with living expenses. I don’t want to go into too much detail but I am grateful that I am able to assist.

In conclusion…

I am still proud of myself for getting close to my monthly goal of a 50% savings rate. I will continue to do these budget breakdowns to find ways I can optimize my spending and hopefully slowly increase my savings.

Do you track your monthly spending? If so, I’d love to know any frugal tips or tricks that you use.