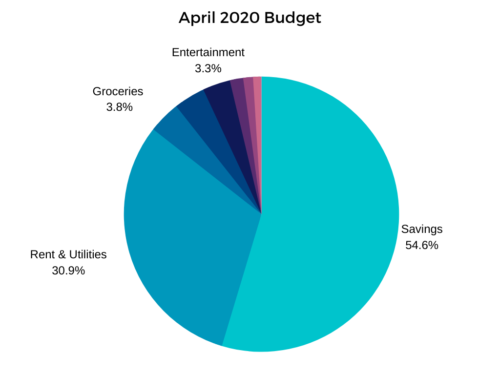

My April 2020 Budget Breakdown- First Full Month in Quarantine 🏠

Well I’m finally taking a shot at creating monthly budget breakdowns. These are blog posts that I love to read from early retirement and FIRE (Financial Independence Retire Early) writers such as Retireby40 and The Purple Life. They are two of my favorite early retirement bloggers whom I admire and have gotten motivation and valuable tips from as I started my journey towards early retirement.

So let’s take a look at my April 2020 budget breakdown category by category. Bear with me as this is my first attempt and I will try post monthly and be as informational and entertaining as possible. ( I hope so! 😂)

Savings $2,000

I’ve been working myself up to having at least a 50% savings rate for the past six months or so. Being in quarantine helped me save about $200 from not having to pay for public transit, saving money on occasional nights in the city with co-workers or friends, and money I saved from not being able to go on any of my pre-planned trips during the summer time (I’m still crying about this one but I’m sucking it up 😭).

I recently opened up a Credit Karma high yield savings account and transferred the majority of the savings that I had in my Wealthfront account into there. My Credit Karma account currently earns me 0.56% APY but will surely go up to 1.5% APY when the economy bounces back and the Fed allows rates to go back to April.

I had a huge boost from receiving $2,400 from the CARES Act which I wrote about in a previous blog post. In April I finally completed my 3-months emergency fund and am now working to work my way up to a 6-month emergency fund hopefully by the end of August.

Rent & Utilities $1,132

If you’re new to my blog, then you may not know that I live in the San Francisco Bay Area. The East Bay to be specific. This area of the U.S. or California for that matter isn’t known for being super affordable but with some careful planning, research, and having a roommate (mine is my husband) the costs can be reasonable.

My half of the rent for our $2,064 1-bedroom, 630 square foot apartment is about $1,032 and we also split our gas and electric costs. After everything adds up I end up paying about $1,100 give or take. This month we also received a $30 credit towards our PG& E (Pacific Gas & Electric) bill which helped to off set our costs.

Groceries $138.39

I surprised myself with how low my groceries costs were this month. I’m sure that a big factor to it is the fact that I share the cost of groceries with my husband and I also only bought groceries using Instacart this month. I’m a big fan of Choose FI, an amazing FIRE podcast that mentioned buying groceries with Instacart to eliminate the impulse purchases that most people make at the grocery store.

Even though I’m actively trying to be conscious of how much money I spend and what I buy at the store, even I can fall prey to a shiny candy bar or a new pack of gum at the checkout line and mindlessly toss it into my cart.

Charitable Giving $234

I normally give $35 per month and $99 every quarter to the Childfund and Save the Children. I sponsor two smart, adorable girls in Kenya and that money helps to pay their school fees, school supplies and provide safe drinking water for their village. This was a reoccurring expense that I was expecting to have.

This month I also donated $100 to specifically help out one of my favorite restaurants, Golden Safari, that makes Nigerian food, provide hot lunches to first responders in Alameda County in the East Bay Area. The people that own and work at the restaurant started a GoFundMe account to help fund their efforts. I didn’t hesitate to help donate to their good cause.

Entertainment $12.99

Most people already probably know what this is! NETFLIX! This streaming service is in my rotation along with Amazon Prime and YouTube to provide me entertainment when I’m not working, reading, walking or talking to friends and family.

Household Shopping $57.22

These purchases were kind of boring but I’ll still go over them. I bought a set of 6 dinner plates, a gentle face cleanser, and toilet cleaner. Nothing fancy, but just normal household goods.

Restaurants (Takeaway Food) $24

California is under Shelter in Place until May 31st (as of now) and so we weren’t eating inside the restaurant, but we ordered takeaway from a restaurant. We then took that food and had a picnic in the park. We stayed 12+ feet away from all other people and got some fresh air on a weekend that was much needed.

Credit Card Interest $35.99

These is credit card interest that I paid. I paused my debt snowball after the coronavirus hit California to help out me save money for an emergency fund much quicker. I reduced the amount of money I was using for debt payoff to make sure I had cash on hand in case of a layoff or another emergency that may come until the economy recovers.

In conclusion, I think that I will continue to do these monthly budget breakdowns to give me more insight into what I spend, what I save, and to be able to make improvements that will bring me closer to my personal finance goals of saving a 6-month emergency fund, then investing in mutual funds, saving for a house, etc.