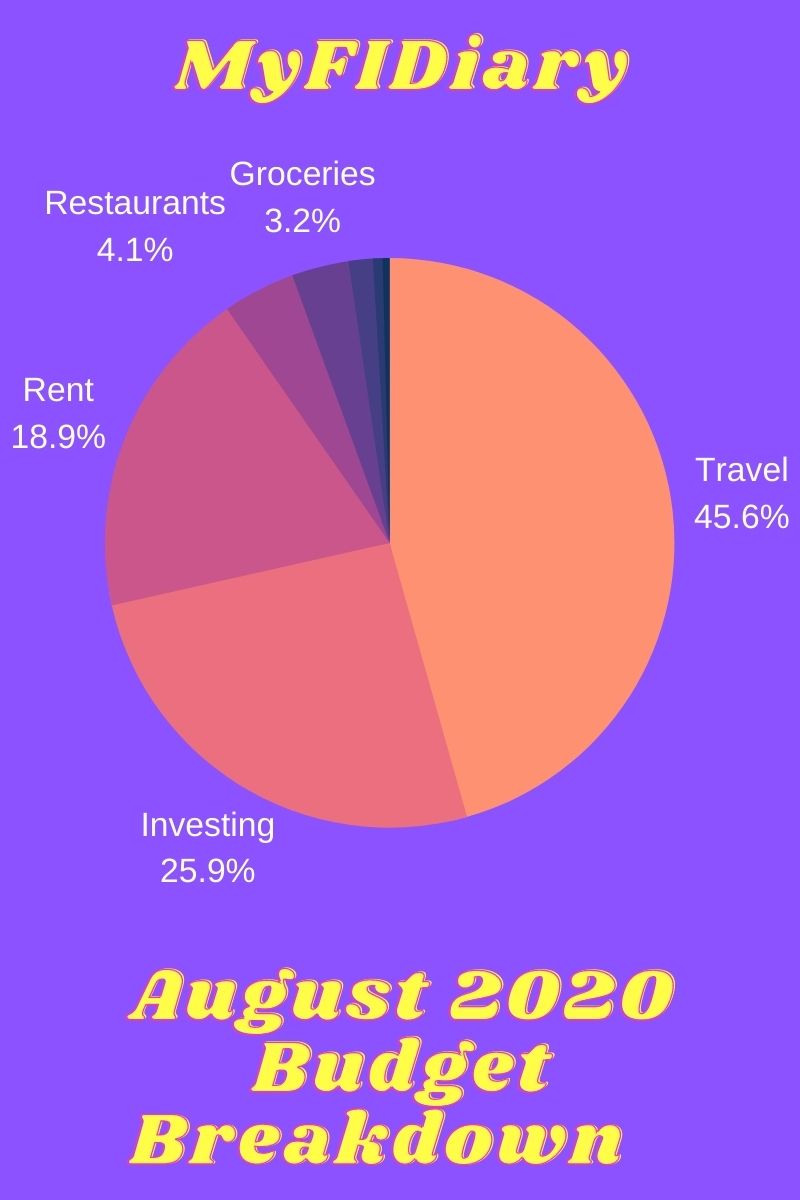

August 2020 Budget Breakdown

Hello everyone! If you’re new to my blog, at the beginning of each month I take a look at the previous month to see what I saved, invested, and spent. I’m in the beginning stages of my journey to reach early retirement and reach financial independence. A great way to do this is by tracking your expenses, which I do with a great platform called Personal Capital which is completely free to use. I have all of my checking accounts, credit cards, 401k, Roth IRA, and brokerage account linked to it which makes it easy to get a birds-eye view of my spending and saving habits.

If you missed my July 2020 budget breakdown you can read that by clicking here. This month I did some unexpected travel to Atlanta, Georgia to help my mother move back to her home country. I had some travel expenses that I don’t normally have. But, life happens and I still make sure that I stay consistent with my savings and investing goals in order to stay on track for my goal of early retirement. So, here we go!

Savings & Investing $1,700

This month is the first month of investing $1,000 per month into my Vanguard brokerage account. This is the account that will provide me with income for early retirement because I don’t have to wait until I am 59.5 years old to draw money from it. About 90% of it goes towards the Vanguard Total Stock Market ETF (VTI) and about 10% goes into the Vanguard Total Bond Market ETF (BND). I just buy shares based on the dollar amount after the amount has been automatically transferred from my savings account. I also invest $500 per month into my Vanguard Roth IRA to meet the $6,000 yearly limit which also goes into VTI & BND. The other $200 per month goes into my company’s 401k. My company unfortunately doesn’t have a 401k match, so I just started contributing to taking advantage of pre-tax savings. I plan to increase this in the next month or so.

Travel $2,999

This isn’t a normal expense for me and turned out to be my biggest category for the entire month of August. I unexpectedly went to Atlanta, Georgia to help my mother pack and move back to her home country. The majority of the money went towards flights for myself and for her, a rental car for three days, a hotel stays for three nights, and food at restaurants. Even though it’s a large expense I cherished the time that I got to spend alone with my mother, taking her out to eat, watching movies, and being able to connect before she flew back to her home country. She is permanently retiring outside of the USA where she has a home and receives a monthly pension. I hope to see her again in the summer of 2021 when she comes back to the USA to briefly visit my brother and me.

Rent & Utilities $1239.70

I live with my husband in the East Bay area of the San Francisco Bay Area. We split the cost of rent and utilities that include our apartment insurance, our gas bill, the electric bill, water bill, and sewage. I think the price is quite fair considering how expensive the San Francisco Bay Area is. We are planning to relocate to another area of the US by the end of this year to bring down our housing costs significantly. Keep your fingers crossed for us because if we relocate, this item will go down significantly for me. I’ll keep you updated!

Groceries $213.04

I did a great job in this area and managed to spend about $300 less than the previous month. A couple of reasons for this can be that I was away from home for four days and ate out, and we had a lot of bulk food items from the previous month. It was nice to save some money in this category and I plan to continue to keep my grocery bill under $300 per month by sticking to my grocery list and eating everything that I have in my pantry, freezer, and refrigerator.

Charitable Giving $36

I always give $36 per month to the Save the Children which helps sponsor a smart, adorable girl in Kenya. This money goes towards providing her and her family with clean water, school fees, and school supplies. I plan to write to her and her family again soon to make sure they are staying safe during these tough times.

Entertainment $45.39

This category includes my Netflix subscription, Amazon prime membership, a monthly payment to support two YouTubers that I enjoy watching, and a one-time payment during a super chat live video session. These expenses stay the same every month. This category can be eliminated but I get a lot of use from my Amazon and Netflix subscription. I work from home and try to avoid spending too much time in public besides going on walks at the park. I have really been getting my money’s worth lately with all the great movies and shows that have recently been added to both streaming services.

Shopping/General Merchandise $90.31

This cost was less than last month. I bought some bulk snacks on Amazon, some medicine from CVS pharmacy and household items like paper towels and cleaning supplies.

Restaurants $271

I spend four days in Atlanta, Georgia and most of this money comes from food and snacks I bought traveling to and from Atlanta as well as the meals I bought for my mother and me while I was with her. Since international flights run less frequently than normal, we had to wait three days before she was able to take a direct flight and the hotel had a free to-go breakfast but we had to buy our lunches and dinners. There is also an order of chicken wings and Mountain Mikes pizza on here that my husband loves and we tend to buy at least once per month.

In conclusion…

My total spending, savings, and investing this month came to a total of $6,574.83. I had higher than normal expenses in travel this month, spent less on groceries, but managed to still save consistently due to my automatic deductions from my paycheck and savings account. My savings went down from 50% to about 26% but I plan on getting back on track to saving at least half of my income in September.

Do you track your spending? If so, tell me how you do so and I’d be happy to hear from you!