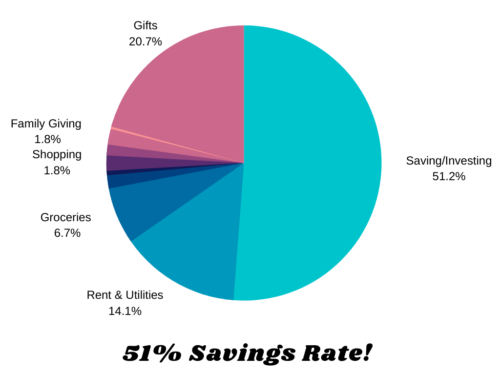

July 2020 Budget Breakdown

Hello everyone! If you’re new to my blog, at the beginning of each month I take a look at the previous month to see what I saved, invested, and spent. I’m in the beginning stages of my journey to reach early retirement and reach financial independence. A great way to do this is by tracking your expenses, which I do with a great platform called Personal Capital which is completely free to use. I have all of my checking accounts, credit cards, 401k, Roth IRA, and brokerage account linked to it which makes it easy to get a birds-eye view of my spending and saving habits.

If you missed my June 2020 budget breakdown you can read that as well. This month I received a commission check so my income was a bit higher than usual. I also had family members staying with my husband and I and spent more money on groceries and bought my brother a gift for his college graduation. I receive commission checks quarterly because I work in software sales so this month’s income is higher than usual.

Savings & Investing $4,460

The majority of this money was put into my new, CIT bank’s premier high yield savings account that I heard about through ChooseFI, one of my favorite financial independence podcasts and blogs. It’s not connected to my main account and I don’t have immediate access to the money. I completed my six-month emergency savings and can now breathe easier knowing that it’s there and gaining a little bit of interest at the same time. I also contributed $1,000 to my normal savings account that I keep for short term emergencies and $300 that automatically goes into my Vanguard Roth IRA for a target-date fund 2050. This fund automatically chooses how much to invest in stocks and bonds based on how close I am to full retirement at the age of 60 which will be in 2050.

Gifts $1,807

My younger brother graduated from college this May and was using a laptop that was almost six years old. I offered to buy him an updated gaming laptop because he has a degree in Computer Science with a focus on video games and simulation. He was unable to work on advanced projects on his older laptop because it wasn’t built to handle the applications that he needed. He is currently beefing up his portfolio and taking additional courses in web development online and I wanted to help invest in his future. This computer should comfortably last him another three years and I was happy to help out.

Rent & Utilities $1230.37

I live with my husband in the East Bay area of the San Francisco Bay Area. We split the cost of rent and utilities that include our apartment insurance, our gas, and electric bill, water bill and sewage. I think the price is quite fair considering how expensive the San Francisco Bay Area is. We are planning to relocate to another area of the US by the end of this year to bring down our housing costs significantly.

Groceries $582

I know, I know, this is a ridiculous amount of money to spend on groceries. I normally spend about $200 less each month for my husband and I. I had two family members staying with me this month who drove to visit us and this money helped to feed them. I also wasn’t paying as close attention to prices, bought some things for my husband’s birthday, and splurged a bit. In August I am cutting back on my grocery budget significantly to get back on track.

Charitable Giving $135

I always give $35 per month to the Save the Children which helps sponsor a smart, adorable girl in Kenya. The other $99 comes out of my bank account quarterly to sponsor another bright, young girl going to school in Kenya. I’ve been sponsoring them for over one year and write them letters as often as I can. I believe strongly in girls getting an education and my money is helping them do that and also provide clean water for their villages.

Entertainment $45.39

This category includes my Netflix subscription, Amazon prime membership, a monthly payment to support two YouTubers that I enjoy watching, and one time payment during a super chat live video session.

Shopping/General Merchandise $155.77

This cost was about the same as it was last month. I got bubble tea for my family on a Saturday, bought a squatty potty accessory for my bathroom (it is well worth it), and bought a pair of hiking boots, hiking pants, a hiking backpack, water bottle and a silicone wedding ring.

Restaurants $110.53

I took a short, weekend trip to Santa Cruz which is only about an hour’s drive away with my family during their stay. We enjoyed the boardwalk, the seafood, the beach, and the change of scenery. During our stay, we enjoyed a hearty lunch of fish and chips by the water, and for dinner, we enjoyed Japanese food which consisted of chicken katsu, sushi, takoyaki, and miso soup. We only went to a restaurant twice and made most of our other meals at home (hence the high grocery cost this month).

Family Giving $160

I give a family member that’s very close to me money each month to help with her necessities. She will be relocating soon back to her home country. I’m very fortunate that I’m able to help the ones that I love and she will soon not need extra help.

Travel $23.28

During our weekend trip to Santa Cruz, I used my Marriott Bonvoy points to book a room for one night and only had to pay $3.48 for taxes. We also had to pay $20 to park our car at the Santa Cruz boardwalk. I cringed at having to pay the price but we had a good day so it was well worth it.

In conclusion…

I had more income this month, spent more on groceries, bought a pricy gift for a family member, but still managed to achieve over a 50% savings rate. I was quite shocked but I’m excited because this was my goal to help me achieve financial independence within 15 years.