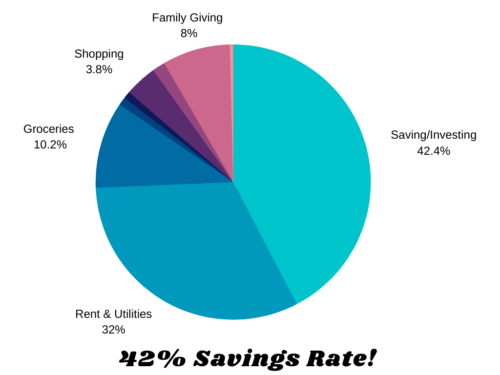

June 2020 Budget Breakdown

Hello everyone! It’s hard to believe that we are over halfway done with the year 2020. This year hasn’t turned out exactly the way that I wanted it to but I’m grateful that it has forced me to take a closer look at how I spend and save my money. It’s allowed me to focus on what’s important in my life and get closer to my goal of debt paydown, investment, and early retirement.

My 30th birthday was in June and made me reflect on the three most important money lessons that I’ve learned before my 30th birthday. So let’s take a look at everything that I spent, saved and invested during the month of July 2020.

Savings & Investing $1594.52

I once again fell below my 50% savings goal for this month but that’s okay. I’m not going to beat myself up but am going to keep working towards it to hopefully hit 50% again by the end of the year. The biggest difference is this month I opened up a ROTH IRA in my Vanguard account and bought one share of a Retirement Target Date Fund 2050 for $1,000. I plan on investing $6,000 each year into my ROTH IRA account on top of investing in total stock market ETFs so that I have two investment accounts working for me. One will be for early retirement and the other will assist with my later retirement (age 60+).

Rent & Utilities $1204.52

I live with my husband in the East Bay area of the San Francisco Bay Area. This cost stays basically the same month to month. Our monthly apartment insurance is at a fixed rate of $18.25 and the only variables are our Pacific Gas & Electric (PGE) bill depending on how much we are using our oven or the heater. Our water bill is split evenly between all residents so we don’t have much control over that either. The weather so far has been in the 70’s and occasionally goes into the 80’s (Fahrenheit). When it does, I simply turn our fans on and open our patio doors to let the air blow through our apartment. It rarely gets too hot in Northern California like it did when we lived in Texas.

Groceries $383.92

I came at about $100 more than last month in this category. I anticipated this because I currently have family that drove into visit us for a few weeks in the month of July. They arrived at the end of the month and I bought some food and house supplies to help feed two more people. I’m guessing that next month’s grocery bill will be even higher. Once they leave I’ll try to bring it down to be much lower to even out the expense for the entire year.

Charitable Giving $35

I always give $35 per month to the Save the Children which helps sponsor a smart, adorable girl in Kenya. This money helps to pay her school fees, provide any needed school supplies, and provide clean water for her family in her village. This is a constant and doesn’t change unless I decide to give more.

Entertainment $29.63

This includes Netflix and YouTube creator support to two Vloggers that I decided to support with a $5 per month payment. I watch and enjoy their content and felt that this small payment is a token of my appreciation that I could afford to give. The only difference is that I gave an additional $5 or so during a super chat during a live stream video on YouTube to show some extra support.

Shopping $143

This area also had a sharp increase compared to last month. I had to buy two pillows for my family that is currently staying with my husband and I. We realized we had no extra pillows so we had to run to Target to get two. I also bought three coloring books, a set of coloring pencils, and a birthday gift for myself.

Restaurants $56.75

My husband and I like to go to one of our local parks on Saturday and Sunday to have a lunch picnic and go for a walk around the lake. We got takeaway food from two local restaurants and ate it either under a shady tree or at a picnic table. We always make sure to socially distance and wear a face mask when we need to.

Family Giving $300

I am in a more financially secure position that a close family member. I am choosing to help her pay down her credit card debt and assist with living expenses. This cost is going to stay constant until next year when she will move back to her home country and no longer need the extra help.

Personal Care $15.29

This happens to be my lowest expense for last month. It is my razor subscription that mails me new razor heads every three months and the toothbrush subscription that sends me new toothbrush heads every three months. I’ve just noticed that I have enough refills to last me until next year and canceled both subscriptions.

In conclusion…

Even though I spent a bit more in some areas I am still at over a 40% savings rate. I also started investing in my ROTH IRA and will continue investing in my money market account in July.

Do you track your monthly spending? If so, I’d love to know any frugal tips or tricks that you use.